Listen to this article 3 min

Little more than a year ago, 10x Genomics Inc. won approval to build a 381,000-square-foot corporate campus. Now the company plans to cut its global workforce 8% — about 100 jobs, based on an employee count of 1,250 — and slow new hiring in response to moderate revenue growth, Covid-19 lockdowns in China and other macroeconomic factors.

The Pleasanton-based company (NASDAQ: TXG) will take a $5 million to $6 million charge this quarter mainly to cover cash severance costs.

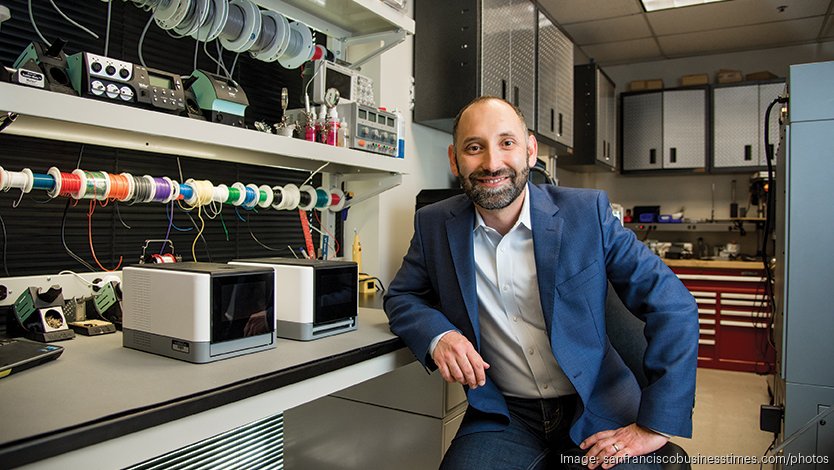

The decision to cut jobs was "not easy but necessary to make 10x more resilient and drive the next phase of growth," CEO Serge Saxonov said Monday. The layoffs will be felt less in research and development and in customer-facing roles, he said.

The company, which last month said it brought on Jim Wilbur as chief commercial officer to boost sales, hopes to break even by the end of 2023.

Ten-year-old 10x, which had 1,239 employees at the end of last year and makes tools aimed at helping scientists quickly, accurately and at-scale examine single cells, has been one of the fastest-growing companies in the broader life sciences space. It opened a manufacturing facility in Singapore last fall, reported second-quarter revenue of about $114.5 million and is constructing a three-building campus on the site of the former Pleasanton Plaza retail center.

The new facility will be completed in the first quarter of next year, the company said Monday, and Saxonov said 10x then evaluate ways to finance that project.

But 10x's second-quarter revenue was down 1% from the same quarter last year. CFO Justin McAnear said the company has seen "some degree of slowness coming out of the first part of the year" across the globe.

Asia-Pacific revenue was down 47% from the first quarter, due primarily to Covid-related lockdowns in China that extended into June and expanded beyond Shanghai. In the European-Middle East-Africa market, there was a delay in orders due to supply chain issues and currency fluctuations.

In the Americas, however, second-quarter revenue was 19% higher than the first quarter.

Still, 45% of 10x's historic revenue has come from outside the United States, McAnear said, with China accounting for about 15% of its business.

10x expects full-year revenue of $500 million to $520 million, an increase of about 2% year-over-year. That modest increase accounts for "lingering macro headwinds," Saxonov said.

The company had about $500 million in cash, equivalents and marketable securities at the end of June.