A fast-growing East Bay biotech tools maker — whose cell-probing technologies have helped revolutionize medical research as well as burden it with patent infringement suits — filed Monday for a $100 million initial public offering.

10X Genomics Inc. of Pleasanton wants to use IPO proceeds for working capital, operating expenses and, possibly, acquisitions as it expands its offerings of so-called single-cell sequencing technologies. The underlying technology allows researchers to peer closely at genes and single cells, part of a revolution that has led to discoveries and new understandings across a range of diseases.

It is a rare life sciences IPO: As a maker of equipment that helps academic and commercial research operations get a closer look at cells, it actually has revenue.

10X, whose stock would trade on the Nasdaq exchange as "TXG," reported a $112.5 million loss last year on revenue of $146.3 million. Its largest investors include San Francisco's Foresite Capital Management at 18.1 percent, Venrock of Palo Alto (16.3 percent), Paladin Capital Group (11.5 percent) and Fidelity (11.3 percent).

The 7-year-old, 500-employee company, which has grown from 110 employees since the end of 2015, had an accumulated deficit of $245.6 million at the end of June. It had cash and equivalents of $56 million as of June 30.

Last October, the San Francisco Business Times recognized 10X as the fastest-growing Bay Area company, based on 2015-17 revenue growth.

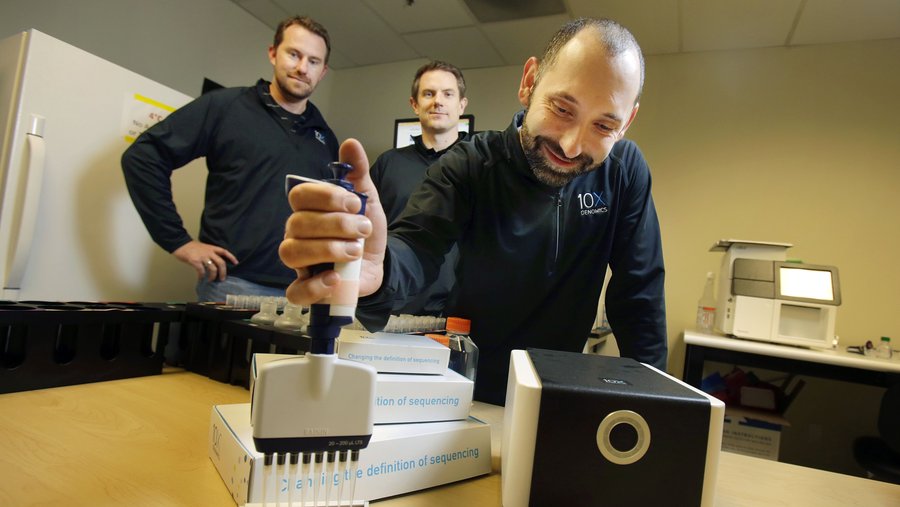

Yet the company's growth since it was founded by CEO Serge Saxonov, President Benjamin Hindson and Kevin Ness, has taken a hit with a patent-infringement suits brought by Bio-Rad Laboratories Inc. (NYSE: BIO) of Hercules and others. One of those suits resulted in a final judgment this month of $35 million and a 15 percent royalty on prior sales and an injunction against using that microfluidic chip technology that constitutes "substantially all" of 10X's product sales, the company said in a filing with the Securities and Exchange Commission.

Bio-Rad also has asked the U.S. International Trade Commission to prevent 10X from importing the microfluidic chips, and a judge recommended an exclusion order. A cease and desist order could take effect in November, the company said.