While generic drugs frequently replace their branded counterparts after the latter lose their market exclusivity, the uptake of biosimilar products is often slower. Further, biosimilars are relatively more expensive compared to generic small molecule drugs. A key question then is how much could payers save by switching to biosimilars after loss of exclusivity.

The is the question that a paper by Dickson and Kent (2021) aim to answer. The authors examine how prices vary for branded, physician-administered drugs which had generic or biosimilar versions introduced before 2005. They use 5 data sources to evaluate these price changes:

- Medicare Part B Average Sales Price (ASP) reimbursement files from Q1 2005 to Q2 2021, to determine reimbursement by HCPCS code;

- Associated ASP crosswalk files, to determine which drug formulations are reimbursed under each HCPCS code;

- Medicare Part B drug spending dashboard (2010-2019), was used to measure annual utilization of Medicare Part B drugs, both brand and generic

- FDA Orange Book, used to determine the number of drug manufacturers that marketed formulations under each HCPCS code

- FDA Purple Book, used to identify the number of manufacturers of biosimilar formulations

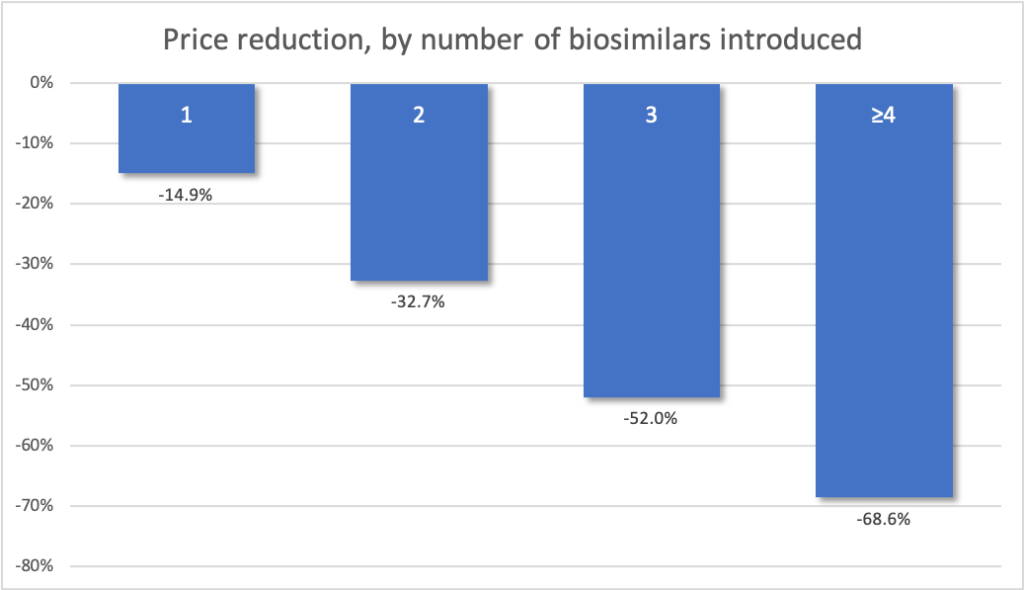

Using these data, the authors implement a linear, fixed-effects time series regression model to estimate how price change after the introduction of a generic/biosimilar competitors (i.e., yes/no) and the number of generic/biosimilar competitors that were present in the market. With this approach, they find:

After excluding the outliers among all drugs in the study, the presence of 1 generic competitor was associated with a 14.9% mean price reduction in the bundled ASP, 2 generic competitors were associated with a 32.7% mean price reduction, and 3 generic competitors were associated with a 52.0% mean price reduction. Additional competitors were associated with a mean total price decrease of 68.6%; all estimated reductions were from the price of the brand-name drug in the quarter before generic competition and not from the price with fewer generic competitors

The paper shows that Medicare could have saved more money with a quicker transition to biosimilar products.

During the modeling period of 2015 to 2019 and for those years with reported Medicare spending on both biologics and their associated biosimilars, Medicare and its beneficiaries spent $6.5 billion on these 6 biologics with their biosimilar versions: Neupogen (filgrastim), Remicade (infliximab), Neulasta (pegfilgrastim), Avastin (bevacizumab), Herceptin (trastuzumab), and Epogen (epoetin alfa)…We estimated that the bundled biosimilar reimbursement model would have been associated with reduced spending on these therapies of $1.6 billion, or 26.6%